An investor presentation is, arguably, one of the most important material for a Life Science company. With a longer time to market compared to companies in other industries, in order to survive, most Life Science companies rely on the financial support of investors to fuel their development programs. In order to woo the next potential investors, many members of the management team have to make a great effort to constantly meet potential investors to get them onboard and invest in their company.

With plentiful of presentations under our belt, we thought to share some of our best tips and advice on how to make a pitch work for potential Life Science investors.

Here are our 10 top tips.

- Executive summary. Here you describe the company, lead development program and/or main assets, and the company’s goal. This slide(s) is recommended to be created as one of the last steps of your whole presentation.

- This slide could include general information of the company such as location, founders, if it’s a project, private or publicly-listed company, latest development stage and focused indications, mission and a highlight or two about the company’s progress (e.g. recent patent approval in the US or positive results in a preclinical disease model showing the desired effects).

- Technological innovation and how it closes gaps of current unmet medical/clinical needs. You can start by providing a brief background of the pursued indication and listing the main unmet medical needs e.g. current treatments are expensive, have serious side effects, are invasive, etc. You can then present what your technical innovation is and mention its technical strengths and commercial potential. Note: in order to avoid massive amounts of text, make sure to simplify some of the information in the form of figures, tables bullet points, etc.

- Data provides credibility. Key results from studies to support the efficacy or safety of your innovation is very important as it provides crucial information to investors about the value of your innovation. Make sure to provide some data (in table, graph, etc.) and summarize in bullet points or a sentence what the main conclusion is.

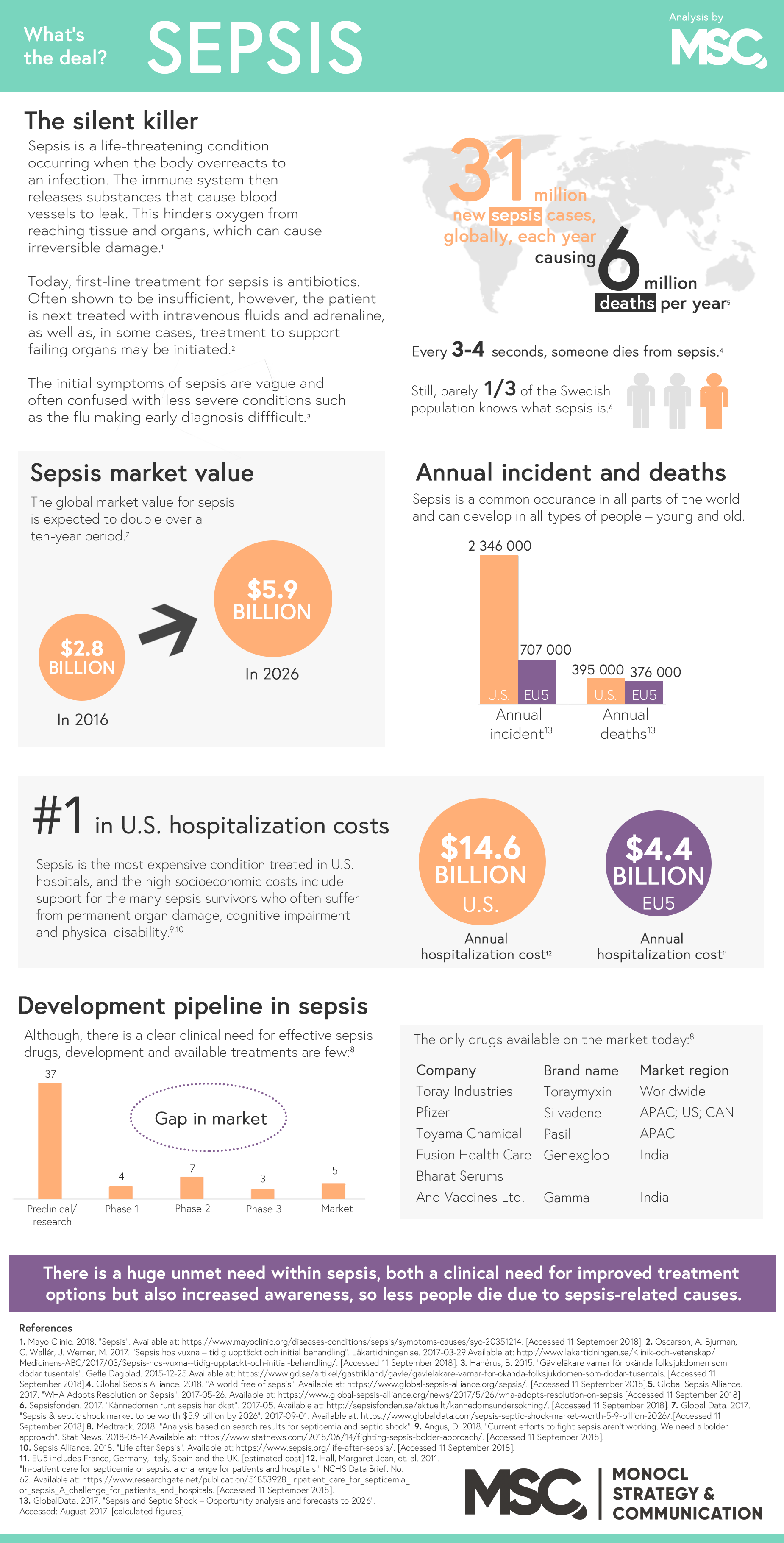

- Market size, potential and opportunity. Remember that many investors constantly have “return of investment” in the back of their minds, therefore you can provide a sense of the potential of the company’s assets by providing numerical estimations. These slides should contain information about the market potential of the target patient population as well as estimations of the market opportunity in specific geographical areas. To provide relevance to the presented numbers a benchmark to market sales of comparable products as well as a benchmark to the whole market size and growth can be presented. Also, from our experience, presenting comparable financial deals that other peers have accomplished in the same space is very interesting.

- Slide about competition. An overview of the competitive landscape or a benchmark of your innovation(s) to current competitors could provide valuable information to your potential investor about the current positioning of your innovation. Information about the competition can provide the potential investor a sense of your business strategy e.g. whether you are pursuing a crowded market with a unique product or you are a pioneer in an untapped market.

- Intellectual property (IP), regulatory environment and development timelines. Intellectual property is very important as it guarantees that you are doing something unique and you can fence off competition through a limited period of time. You can also provide information about the regulatory environment as depending on the nature of your innovation, exclusivity granted by regulatory agencies can fence off competition for longer periods of time compared to your existing IP portfolio. Finally, an investor must know what you are planning to do with money to be raised and this can be done by providing a development timeline or plan.

- Company’s aim/goal and budget. Remember the first tip that I gave you? Well, now that you have presented how great your company and innovation is as well as the potential opportunities, you can tell the potential investor what your aim is to get out of the meeting with them (e.g. need investment of x amount of money to complete a phase 1b study to resume discussions with a Big Pharma potential collaborator). You should also present a budget/use of proceeds from the investment. Note: If you have a good understanding about the development plan and key activities that needs to be performed, you should be able to translate this information to budgetary means. If you need help, make sure to reach out to necessary service providers or benchmark costs.

- Slide about team. In this slide you can present the management team as well as the Members of the Board and/or Scientific Advisory. You can also write a very short summary of their relevant experience or verbally describe it during the presentation.

- Other slides. Depending on the time that you have available and the aim of the meeting, you can add additional slides to this core slide deck.

Hope these tips are helpful in creating or improving your own investor presentation. At MSC, we have a lot of experience in creating investor presentations for different life science companies. Our expertise varies from creating a clean and slick graphical profile to business-related content that truly portrays the potential value that the company’s innovation bear. If you want to talk more, feel free to contact us at msc@monocl.com.

By: Paola Jo, Senior Business Analyst