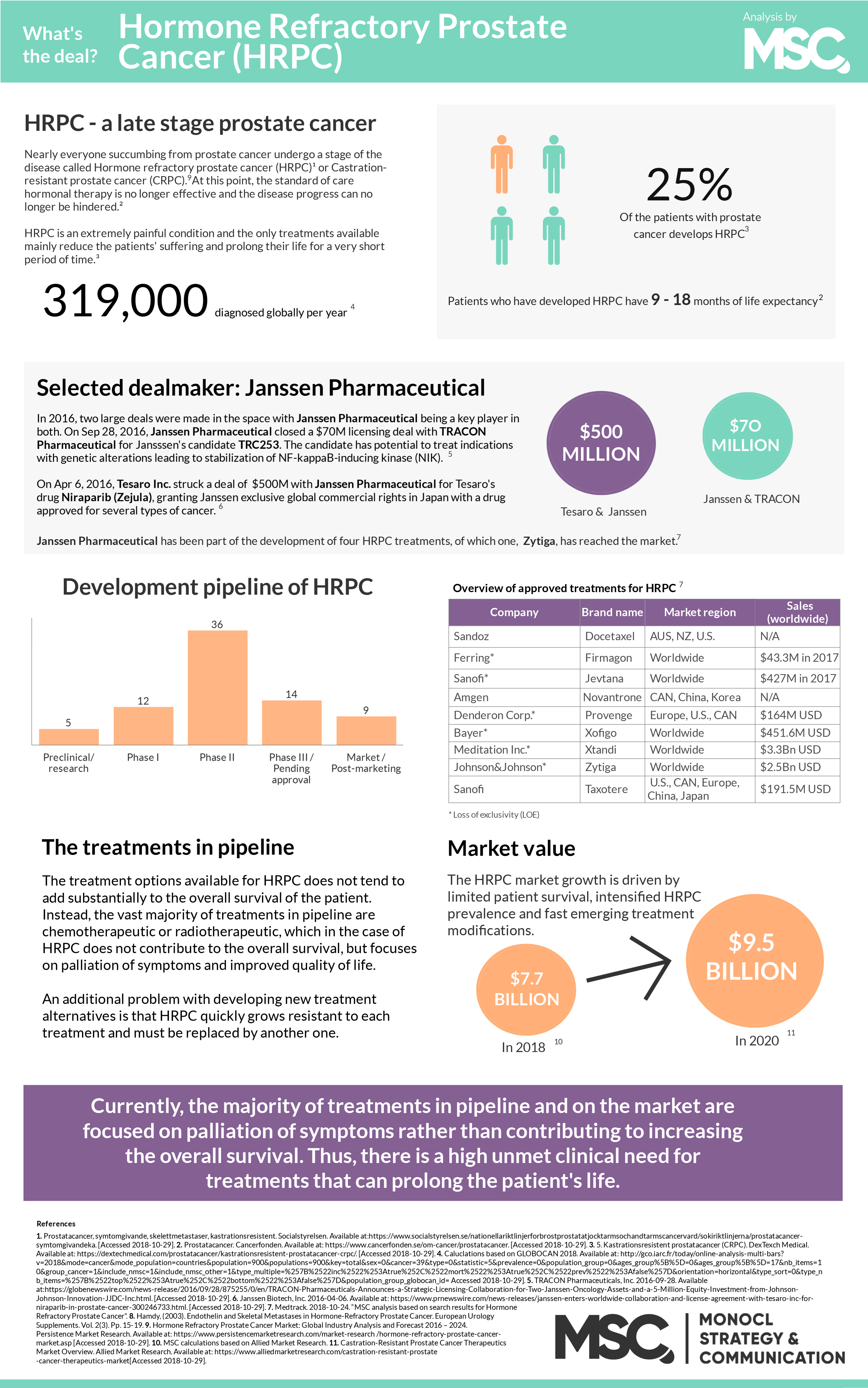

During the month of November, the world’s eyes lie on men’s health. The public movement movember is aimed at preventing premature death among men; primarily looking at diseases such as prostate- and testicular cancer but also mental health issues. Possibly surprising, prostate cancer is shown to be the second most common type of cancer among men globally. The incidence rate is almost 1.3 million diagnoses per year, and nearly everyone succumbing from prostate cancer gets beyond a point where the disease is no longer responding to standard of care hormone treatment. This late stage, called hormone refractory metastatic prostate cancer (HRPC), is extremely painful and its only available treatment does not substantially add to the patient’s overall survival but rather focus on palliation of the symptoms. This is a loud and clear signal for a high unmet medical need.

Globally, 1.3 million men are estimated to be diagnosed with prostate cancer during 2018, and almost 360 000 men will die from the condition.1,2 Generally speaking, prostate cancer has three stages. The first include early prostate cancer where it is possible, but not always necessary, to surgically remove the cancer-infected prostate. In the second stage of the disease, patients are treated with hormone treatment, which inhibits the body’s testosterone production limiting cancer cell growth. When the cancer cells have grown resistant to the hormone treatment, the patient enters the third stage which is referred to as hormone refractory metastatic prostate cancer (HRPC) or castrate-resistant prostate cancer (CRPC). At this point, the patients have no chance of getting cured and the remaining treatment options are lacking.

Approximately 90% of the patients with HRPC develop metastases, mainly in the skeleton, and suffer from extreme pain as the growing cancer cells are constantly putting pressure on the inside of the bone. Most commonly, these metastases develop in the skeleton where there is bone marrow, i.e. spine, pelvis, ribs, upper thigh and upper arm, putting a constant pressure from the inside of the bone as the cancer cells grow. This causes an extreme pain and a treatment used today is where the radioactive substance radium injected into the bone. Currently, the average period of survival for patients affected by HRPC is 9 to 18 months.1

Currently, the average period of survival for patients affected by HRPC is 9 to 18 months.

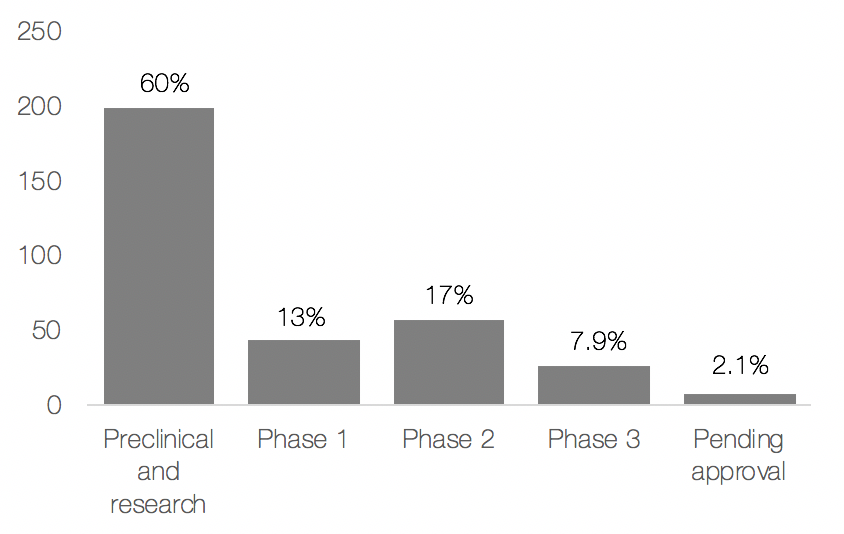

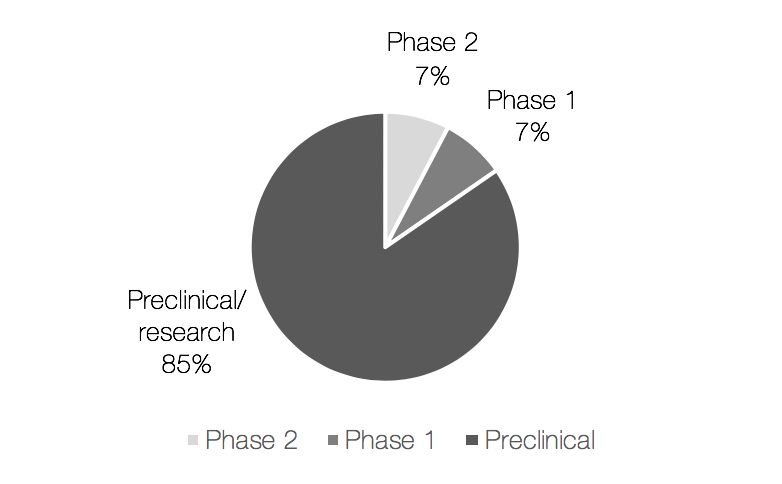

During the 21st century, there has been advancements in the field that has shown to extend a patients’ life after diagnosis of HRPC with up to a few months. Yet, most of the treatments under development are aimed at reducing the patient’s suffering rather than prolonging their life, thus only constituting half of the solution for the affected. As a conclusion, there is today a huge unmet clinical need for treatments that can contribute to a patient’s overall survival, i.e. prolong their life, and reduce their pain even more.

References

1. World Cancer Research Fund. Prostate cancer statistics. Available at: https://www.wcrf.org/dietandcancer/cancer-trends/prostate-cancer-statistics Accessed: 30 Nov 2018. 2. World Health Organization/IARC. Cancer Today – GLOBOCAN 2018. Available at: http://gco.iarc.fr/today/online-analysis-multi-bars?v=2018&mode=cancer&mode_population=countries&population=900&populations=900&key=total&sex=0&cancer=39&type=0&statistic=5&prevalence=0&population_group=0&ages_group%5B%5D=0&ages_group%5B%5D=17&nb_items=10&group_cancer=1&include_nmsc=1&include_nmsc_other=1&type_multiple=%257B%2522inc%2522%253Atrue%252C%2522mort%2522%253Atrue%252C%2522prev%2522%253Afalse%257D&orientation=horizontal&type_sort=0&type_nb_items=%257B%2522top%2522%253Atrue%252C%2522bottom%2522%253Afalse%257D&population_group_globocan_id= Accessed: 30 Nov 2018