Innovations that can contribute to making the world a better place are in broad strokes very much what we at MSC are passionate about. Primarily we keep to the biotech side of the life science space supporting companies with big ambitions to provide new, improved treatments to patients in need. There are, however, more parts to the ‘life science’ area – and emerging innovations in food sciences caught our interest. The seemingly ever so growing trend of plant-based meat alternatives is fuelled by people’s increasing will to ‘do better’ but also a high willingness to invest.

Nowadays, it seems like we are experiencing an epidemic of people becoming vegetarians and vegans. One of the reasons explaining why more and more people are turning into a plant-based diet is because such diet is associated with fewer negative effects on the environment (lower carbon dioxide (CO2) emissions) and is considered healthier and more ethical. Tied to this trend is also the increasing demand for plant-based meat alternatives that exist to satisfy a craving for food with similar taste and texture as meat, but perhaps less ‘guilt ridden’. Meaning that people are enabled to keep to their true values and opinions toward animal-based products, especially meat, while still enjoying it. The demand for plant-based meat alternatives has sky rocketed and has become so popular that we are starting to see more consumer options in the market.

On an economic level, this means that companies investing in the development and production of plant-based meat alternatives have found this area to be quite lucrative. As a matter of fact, the plant-based meat alternative company, Beyond Meat, was able to raise $38.5 million in an Initial Public Offering (IPO) in May and in a matter of two months, the share price surged from $25 to as high as $234.90 per share. Although the share price has decreased since then for a number of reasons, the growing trend for plant-based meat alternatives has not halted. In connection with this IPO, it has been rumored that the main competitor, Impossible Foods, would also aim for an IPO, however CEO Patrick Brown has announced that this isn’t a current plan for the company and the aim is to raise money in other ways. This is a completely reasonable move given that the private company has been able to raise a total of $687.5 million since its founding in 2011.

“Now, many of you might wonder… Are there a lot of investments in plant-based meat alternatives? The simple question is yes!”

Are plant-based meat alternatives a temporary hype or an increasing trend?

To determine how popular the plant-based diets topic has become, MSC made an analysis of the publications, patents and investments around this area since these data would provide evidence that supports people switching to plant-based diets, quantify availability and development of technologies that would cater this market and provide a snapshot of the financial support that exist to push plant-based meat alternative products to the market and at an industrial level.

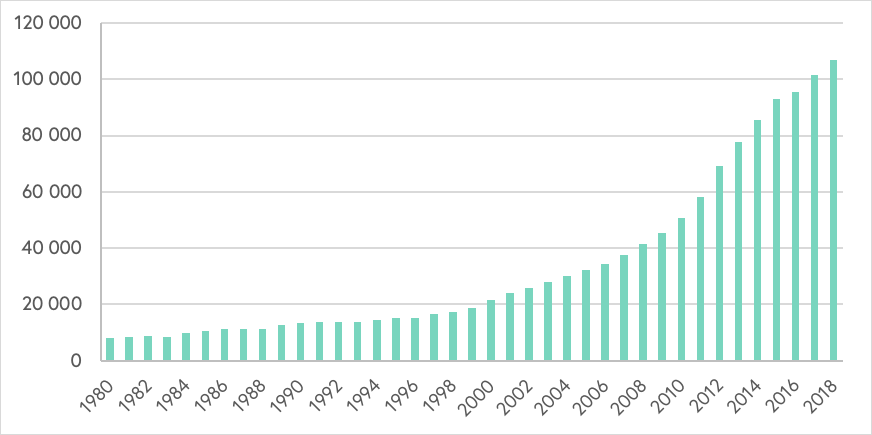

According to an analysis of publications relating to vegetarianism or veganism (see Figure 1), the number of publications has increased by 619% from 2018 – 1998 (106,758 vs. 17,229 publications). Thus, this highly correlates to the popularity that this type of diet has gained over the years. Also, by judging from the shape of this graph, publications relating to vegetarianism or veganism is nowhere close to plateau and we could expect to see more publications relating to this topic in the upcoming years.

Figure 1. Publications relating to veganism and vegetarianism from 1980 to 2018 (Data sourced from PubMed in Nov. 2019)

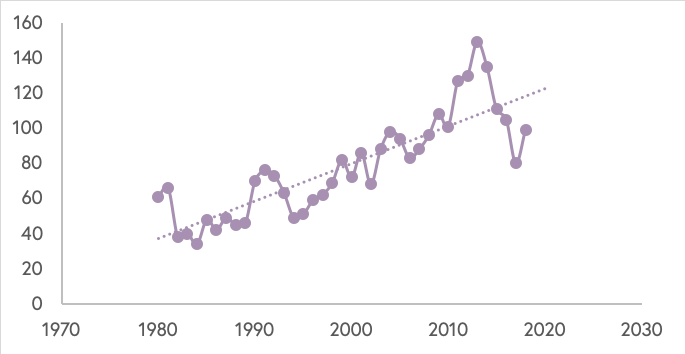

As mentioned previously, the demand for more environmental, healthier and ethically produced foods correlate with the increasing development and innovations for plant-based alternatives. These innovative technologies vary (cultured meat, algae derived, insect derived or plant derived) and are developed to cater slightly different markets (dairy, poultry, meat, etc.). For example, Motif FoodWorks focuses on fermentation to brew vital proteins and nutrients to create meat alternatives from plants, Impossible foods develops new generation meats and cheeses made entirely using plant cells, and Redefine Meat is focused on 3D printing animal-free meat. These and other companies have developed their own proprietary technologies and patented accordingly to fence off future competitors. To get an overview of the amount of technologies that are being developed and patented in these areas, an analysis of granted patents for meat analogue, meat alternative, meat substitute, mock meat, faux meat, imitation meat, vegetarian meat and vegan meat was performed. As seen in Figure 2, the number of granted patents in this field is mostly increasing where most patents were granted in 2013. Thus, this signals that individuals, institutions or companies are still innovating in this space.

Figure 2. Granted patents for plant-based meat alternatives (Data sourced from Google Patents in Nov. 2019)

Now, many of you might wonder… Are there a lot of investments in plant-based meat alternatives?

The simple question is yes! Compared to other areas in Life Science (Medtech, biopharmaceuticals or diagnostics), plant-based meat alternatives pose a lower risk and shorter time to market. Since there is also a high demand, there is a substantial amount of money that is being fuelled towards companies developing and commercializing plant-based meat (and dairy) alternatives.

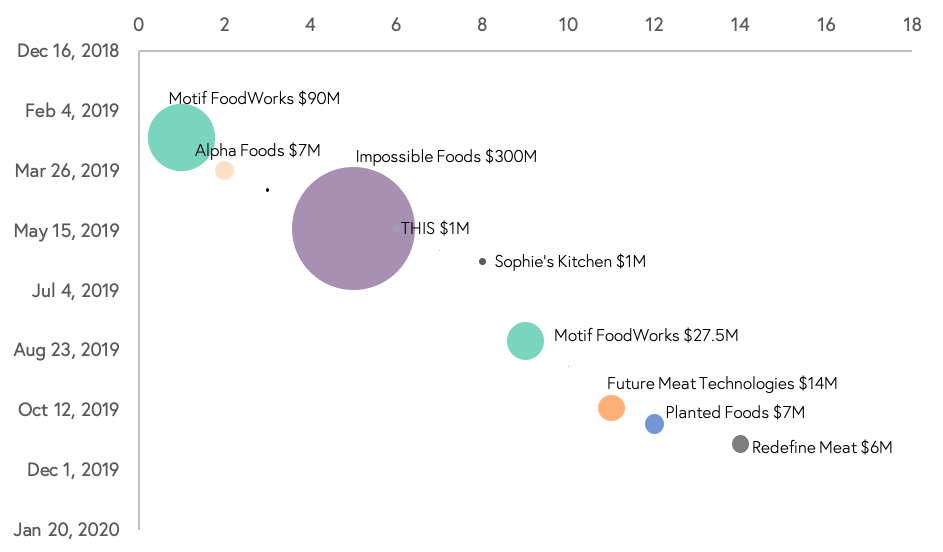

Based on an analysis of investments in companies developing (see Figure 3), producing or commercializing plant-based meat alternatives from the beginning of 2019 to mid-Nov 2019 it was determined that more than $456 million has been invested in this type of companies. Furthermore, the largest investment this year was made at Impossible Foods, where the company raised $300 million in a series E financing round. This investment round was not only backed by top tier institutional investors such as Khosla Ventures, Microsoft Corp co-founder Bill Gates, Google Ventures, Horizons Ventures, UBS, Viking Global Investors, Temasek, Sailing Capital, and Open Philanthropy Project, but also celebrities like Jay-Z, Will.i.am, Jaden Smith and Katy Perry, and Serena Williams. Following in terms of largest investments made is Motif FoodWorks with $117.5 million (cumulative in 2019), Future Meat Technologies with $14 million, Planted Foods with more than $7 million and Alpha Foods with $7 million.

Figure 3. Investments in companies developing and commercializing plant-based meat or dairy alternatives (Data sourced from Crunchbase, Nov. 2019). Note: investments <$1M shown but not labelled.

Although the term ‘plant-based meat alternative’ is not new, a technology leap has been observed in the recent years. This has not only prompted the increasing technological development to cater the hungry vegetarian and vegan market but has also prompted the founding of at least 19 companies since 2015. What is even more interesting is that the startups that were founded in 2019 – Black Sheep Food, Planted Foods and Motif FoodWorks – managed to cumulatively raise more than $125 million since the beginning of 2019. Although the current trend is plant-based meat alternatives, we could expect to see more technological innovation in algae or insect derived meat alternatives and cultured meat in the future, however, these depends in the advancement of corresponding technologies.

Concluding thoughts

Consumption of animal-based products (specifically, red meat) has been negatively perceived by some due to the way it is processed, the unethical treatment of animals, amount of CO2 emission and more importantly, that it has been believed that a heavy meat-based diet has a negative impact in our health. Based on these facts, some people have taken the initiative to decrease animal-based products in their diet and some have even taken it as far as becoming vegans. Others have simply taken the easy route of accepting the truth or just ignoring the obscure reality of the meat industry. Either way, plant-based food alternatives provides an option to all these personas. For example, meat-lovers could potentially enjoy a nice plant-based meat burger that mimic the real taste of beef while vegans would be able to consume the recommended daily protein intake (50g). Due to the value proposition that current companies developing and commercializing plant-based meat alternatives provide to us and our society, we are starting to see a lot of tractions and investments in this area. This field is, however, at its nascent stage and we could expect to see a lot more investments pouring into this area. As more technologies develop and more options become available to the consumer, there would be more discussion and challenges around meat alternatives, e.g. will production of cultured meat be sustainable or is the consumer willing to eat meat developed from protein extracted from insects or can there be production of algae based meat alternative at an industrial level and at an affordable price?

Either way, here at MSC we like to follow major trends in Life Science and provide our current readers (and ourselves) with some food for thought. We have the tools and experience in conducting market analysis more in depth. So, if you are interested in exploring more market information in a Life Science topic, feel free to reach out to us.

By: Paola Jo, Management Consultant at MSC