During 2018, 12 life science mergers and acquisition (M&A) deals took place in Scandinavia for a total value of $11.5 billion. After a year with several inbound and outbound deals, we can conclude that Scandinavian life science companies beyond doubt are becoming more and more established in the world. But in which areas and within which fields are these deals taking place? To answer this question, we took a deep dive into the 2018 M&A activities of the Scandinavian life science industry!

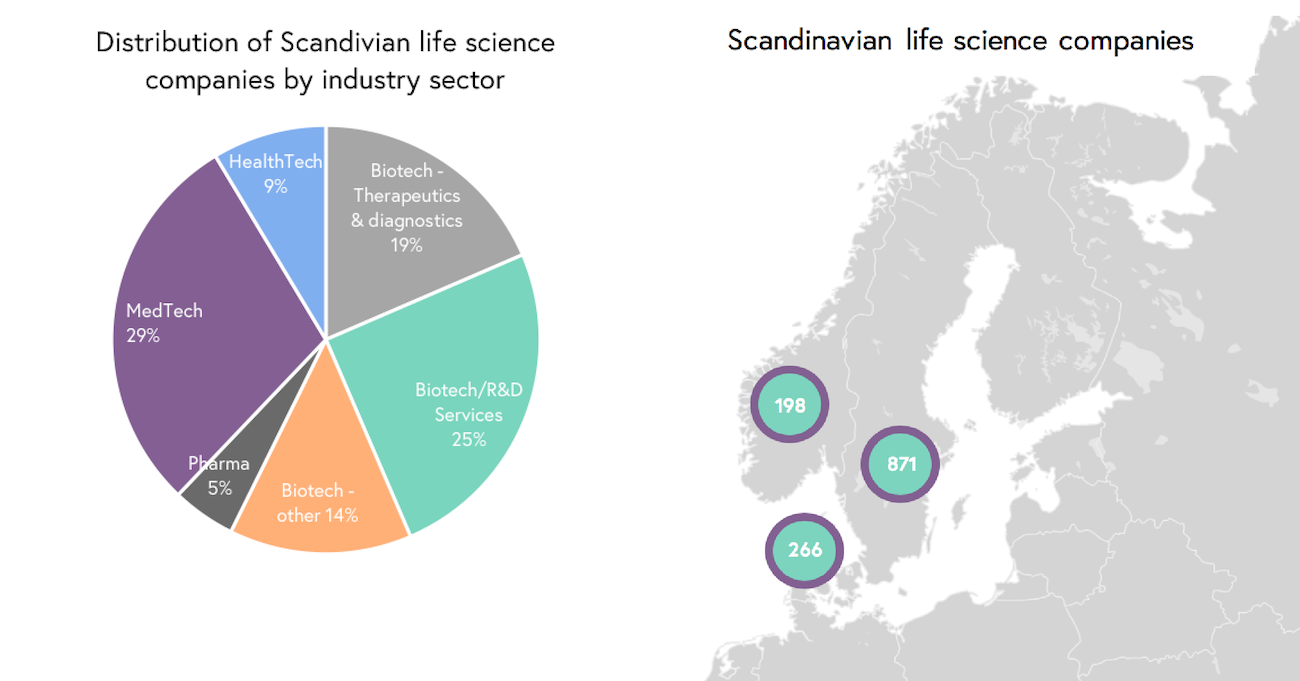

Life science is a broad field, where companies can be divided into four different subsectors that include biotech, pharma, medtech and healthtech (see Figure 1). The biotech sector is the largest of them (total of 58%) and is in turn divided into four subsectors. Given the market size, it is unsurprisingly also the sector with most M&A deals. Following this is the medtech sector, which makes up almost one-third of the life science industry (29%) and bore the largest valued M&A deal in 2018.

In total, the Scandinavian life science industry comprises more than 1,330 companies (see Figure 2), where most companies are located in Sweden (65%), followed by Denmark (20%) and then Norway (15%). Due to the innovativeness and quality products/services developed in this region, these companies represent potential opportunities for M&A deals in the life science Industry.

Note: This is an analysis of selected M&A or asset acquisition deals with publicly disclosed deal values. Deals with undisclosed values have not been included.

Sweden

Sweden is Scandinavia’s largest country in terms of landmass, population and number of life science companies. Only in 2018, Swedish companies spent about $492.4 million (see Table 1) on the acquisition of other companies or assets, where 96% was spent in international companies or assets and 4% remained within national boundaries. In terms of inbound deals, only two Swedish companies were acquired. The total sum of these acquisitions amounted to $860.6 million, where the majority stems from the American company Alexion Pharmaceuticals’ acquisition of Wilson Therapeutics for $855 million.

Swedish M&A in 2018

| Acquirer | Acquired | Assets/services involved | Total deal value |

| Biotage (Sweden)* | Horizon Technology (US) | Provider of systems and consumables for separation in water purification, food safety, petrochemical industry, biofuels, agriculture and the pharma industry | $17.9 million |

| AddLife (Sweden) | Wellspect HealthCare (Sweden) | Business in surgery and respiration | $20 million (€18 million) |

| Biotage (Sweden) | PhyNexus (US) | Dual flow chromatography and patented tip technology for higher throughoutput purification | $21.5 million |

| Recipharm (Sweden) | Sanofi (France) | Manufacturing center and business in respiratory diseases | $58 million (GPB 45 million) |

| Recipharm (Sweden) | Nitin Lifesciences (India) | Pharma company with strong presence in injectable manufacturing | $86 million (824 million SEK) |

| Karo Pharma (Sweden) | Leo Pharma (Denmark) | Product portfolio in infection, cardiovascular and dermatology | $289 million (€260 million) |

| Ultimovacs (Norway) | Immuneed (Sweden) | Immunotherapy technology business | $5.8 million (50.4 million NOK) |

| Alexion Pharmaceuticals (U.S.) | Wilson Therapeutics (Sweden) | Novel therapies in rare copper-mediated disorders, including WTX101 product | $855 million (7.1 billion SEK)

|

Denmark

Denmark (Greenland exempted) is a small country with a high density of life science companies. From the selected deals in 2018, Danish companies spent about $1.8 billion in the acquisition of other European companies or assets. In terms of inbound deals, three Danish companies were acquired for a combined value of a hefty $8.6 billion. The deal between Widex and Sivantos alone was valued at $8.3 billion and is considered the largest M&A deal in Scandinavia during 2018.

Danish M&A in 2018

| Acquirer | Acquired | Assets/services involved | Deal value |

| Novo Nordisk (Denmark) | Ziylo (UK) | Science incubator (including glucose binding molecule platform) | $800 million |

| Lundbeck (Denmark) | Prexton Therapeutics (Netherlands) | Foliglurax in the treatment of Parkinson’s disease | $1 billion (€905 million): |

| Virtus (Australia) | Triangeln Fertility Clinic/ Fertilitetsklinikken Trianglen (Denmark) | Treatment of fertility | $30 million (202 million DKK) |

| Karo Pharma (Sweden) | Leo Pharma (Denmark) | Product portfolio in infection, cardiovascular and dermatology | $289 million (€260 million) |

| Sivantos Group (Germany)* | Widex (Denmark) | Hearing aids | $8.3 billion (€7 billion) |

Norway

Norway has the highest GDP per capita and is known for its innovativeness and openness to new technologies. As an example, Norway was the first Scandinavian country to approve a CAR T-cell therapy (gene therapy): Luxturna. In 2018, only one acquisition deal with disclosed values was identified. This deal was Ultimovacs’ acquisition of the immunotherapy technology business Immuneed for $5.8 million.

Norwegian M&A in 2018

| Acquirer | Acquired | Assets/services involved | Deal value |

| Ultimovacs (Norway) | Immuneed (Sweden) | Immunotherapy technology business | $5.8 million (50.4 million NOK) |

Concluding thoughts on an increasingly stronger life science field

The M&A and asset acquisition scene of Scandinavian life science companies is on fire with several large cross-border deals taking place in 2018. Acquisitions performed by American, Australian and European companies strongly signal Scandinavian companies’ international reach. Nevertheless, there were more outbound than inbound deals involving Swedish companies suggesting that Swedish companies may often both be financially healthy, and business savvy, to expand their operations and presence internationally. Denmark, on the other hand, is home to the big and internationally established companies such as Novo Nordisk and Lundbeck. Therefore, it is not surprising that these companies performed high-value deals with other European countries. Furthermore, a major oncology cluster is located in Norway and this means that over the next couple of years, we may continue to see inbound and outbound oncology-related M&A deals in this country.

Companies in Sweden are often both financially healthy, and business savvy, enough to expand their operations and presence internationally.

Based on the high concentration of life science companies located in Scandinavia, we may continue to see an increasing number of M&A deals in these sectors. Although the majority of acquisition deals belonged to biotech companies, especially those developing therapeutics, the highest valued M&A deal in 2018 took place between the two medtech companies Sivanto and Widex. Medtech companies have a shorter time to market and when these companies reach the market and become established in the market, the acquisition value increases. Thus, this is a perfect example of how more mature innovative companies are valued higher in an M&A, whereas high risk early stage companies, such as those developing therapeutics, are valued slightly lower in upfront payments, and oftentimes include milestone payments and/or potential royalties to leverage risk and compensate for their high valuation.

Finally, the healthtech sector is still in an embryonic stage and it is just starting to blossom. For example, the company Tunstall Healthcare acquired Danish company EWii Telecare for connected healthcare products and tele-medical solutions for various patient groups. This sector should not be underestimated since the whole field is moving more towards personalized and connected healthcare. Therefore, it will not be a surprise if the number of deals in this sector increases in the upcoming years.

By: Paola Jo, Management Consultant